Grant Audit Requirements and Thresholds

State grant recipients who have received above a certain amount of state funds in a single year are required to provide a single or program specific audit. The program audit is also called the Yellow Book audit. A Yellow Book audit is an audit conducted under the Generally Accepted Government Auditing Standards (GAGAS). See 09 NCAC 03M.0205 for more information.

How to know if your organization must submit a grant audit to OSBM

Grant recipients should use the TOTAL amount they received in all state directed grants to determine if they have reached the threshold to require a Yellow Book audit.

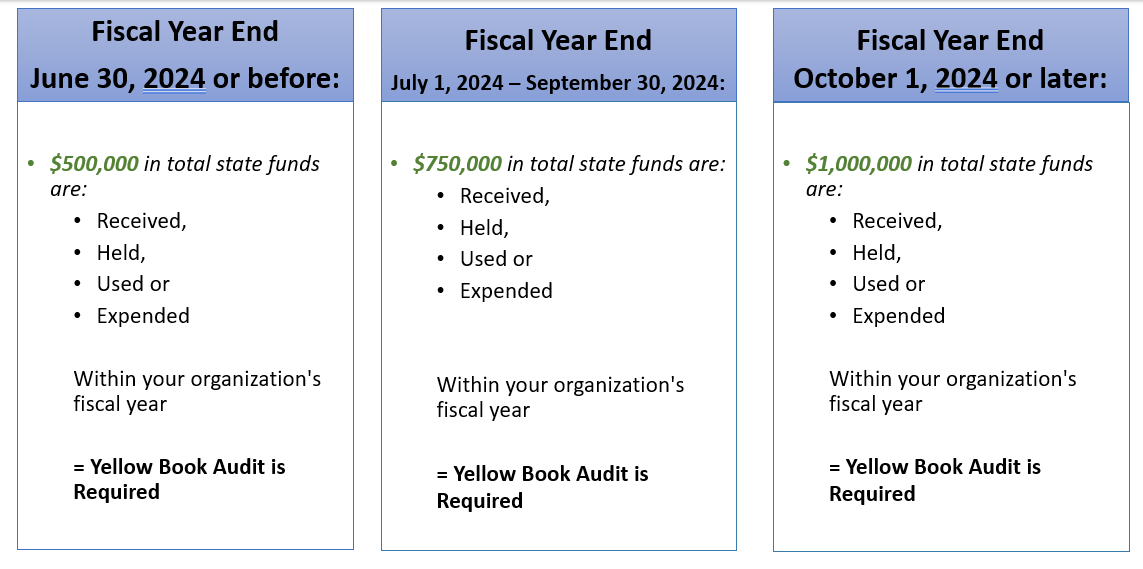

If your organization's fiscal year ended:

- prior to July 1, 2024, the threshold to trigger the audit requirement is $500,000 in total state funds, per the state administrative rules in place prior to July 1, 2024

- between July 1, 2024 and September 30, 2024, the threshold is $750,000, per federal requirements in place at that time

October 1, 2024 or later, the threshold is $1 million, per current federal requirements

Financial thresholds for grant audits depend on the date of the grantee fiscal year end.

Any organization that receives, holds, uses, or expends state financial assistance in an amount equal to or greater the dollar amount requiring audit listed in federal code 2 CFR 200.501(a) should have a single or program specific (Yellow Book) audit completed annually.

How to complete the grant program audit

All audits must be completed in accordance with the Generally Accepted Government Auditing Standards. Please see 09 NCAC 03M.0205 for more information.

Grant recipients may choose to do a program specific audit, which would only include the directed grant funds. A program specific audit is more cost effective because of its narrow focus.

If the organization already conducts a single audit (which is broader than the program audit) that may be submitted to meet the requirement if the grant funds are included in the scope of the audit.

Please see the Compliance Supplement document for more detail on how audits should be performed for OSBM administered grants. Provide this document to the accounting firm doing the audit.

When is the audit due?

Audits must be submitted within nine months of the end of the grant recipient’s fiscal year.

They are due every year until the grant funded project is completed.

More Resources

North Carolina State Treasurer Guidance to Local Government on audits, including sample RFPs.

OSBM guidance to community colleges and state universities on audits.